How does Station A calculate the financials for a solar system?

The financials of a solar system are represented in payback period or the time it would take for a system to recoup its initial investment.

To get to this value, we size a solar system to maximize the financial return using Net Present Value (NPV) by taking into account the (1) technical potential of a site e.g. rooftop space, (2) the build cost / CAPEX incorporating any available incentives, (3) the energy consumption of an occupant, and the (4) avoided costs the tenant and/or landlord would receive inclusive of local net metering / billing policies such as CA NEM3.

Step 1: Compute the technical potential of a site

In order to figure out the sizing and savings potential of a solar installation, we need to determine the solar yield, the number of kWh we expect the system to produce annually for each kW of capacity installed. We do this by looking for the nearest US Weather Station and using TMY3 weather data as the weather in a typical year. TMY3 weather years are created by taking the actual weather from a different year for each month, choosing the year in the period 1991-2010 that has the median average temperature in that month.

We then use NREL's PVWatts to calculate the solar yield for an installation at this building, using the following assumptions:

| Input | Assumed Value |

| Array Capacity | 500 kW |

| Azimuth | 180° |

| DC:AC Ratio | 1.2 |

| Efficiency | 96.0% |

| System Losses | 7.8% |

| Tilt | 11° |

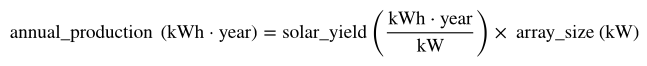

Once we have the solar yield, we can multiply the system size by solar yield to get the expected annual production for that solar array:

Step 2: Calculate the build costs / CAPEX inclusive of any available incentives

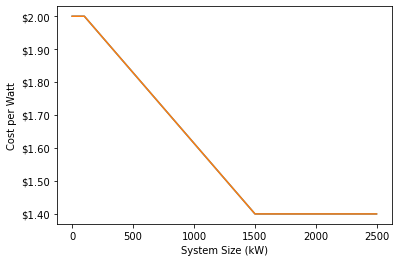

We calculate the CAPEX based on the size of the project and the cost per watt to build. We determine cost per watt based on the system size, with the relationship shown in this graph:

We also subtract the available federal and state incentives as subsidies to that initial cost.

Step 3: Size the system to maximize Net Present Value (NPV)

Forecast an Occupant's Energy Costs

Sometimes, the technical potential of a site is higher than an occupant's actual expected energy use.

Estimate the Avoided Cost

To understand the customer's savings, we have to know how much money they save by not consuming electricity from the grid, which is known as their "avoided cost." Replacing a kWh from the grid with a kWh from their rooftop solar array affects the different types of utility charges differently:

| Charge Type | Portion Avoided by Solar |

| Energy Charges | 100% |

| Demand Charges | 30% |

| Fixed Charges | 0% |

We use these assumptions and our data on the cost of electricity to calculate the avoided cost for each kWh of solar energy produced.

Incorporate Net Metering / Net Billing Policies

Increasingly, exported energy is not credited at the same rate as imported or consumed energy. In places were the exported energy is given a significantly lower value i.e. see CA NEM3, it does not make financial sense to oversize a system even if there is space to support it.

Step 4: Discount future bill savings and compare against initial investment to get payback period

To get payback period, the annual forecasted electricity bill savings are applied to the initial investment with one adjustment -- future cash flows are discounted at 10% per year.